In-Depth Industry Overview - U.S. Franchised New Car Dealerships

Low-margin but (surprisingly) asset-light industry combined with good historical capital allocation

In October 2022, I wrote an article on Group 1 Automotive GPI 0.00%↑, which also provided a high-level industry overview of U.S. franchised new car dealerships. This new article will discuss the industry in more depth, and contains the following sections:

Overview

Long-Term Trends

Competitive Advantages

Industry Economics

Post-COVID Industry Situation

Future Risks/Changes to the Industry

Overview of the Public Auto Dealers & their Capital Allocation Strategies

Summary

1.) Overview

Every U.S. new car dealership is four businesses: (1) new car sales, (2) used car sales, (3) parts & service, and (4) finance & insurance.

Although new and used car sales drive most of the revenues, they do not drive most of the profits. As an example, although ~78% of revenue generated by AutoNation is derived from vehicle sales (new+used), those sales only generated ~32% of gross profit. And, those figures are slightly distorted due to new vehicle shortages still temporarily inflating 2023 new vehicle gross margins.

Explaining this revenue/profit mismatch is the margin differential between business lines. Pre-COVID, new car margins were ~5% and used car margins were ~7%. However, parts/service margins are ~45% and finance commissions ~100%. Understandably, the ~10x higher parts/service margin substantially shifts the gross profit contribution mix substantially.

The benefit of a business model based on parts/service is more resiliency during bad economic environments. In 2008-2009, new car sales dropped by ~50%, while dealer parts/service revenue only dropped by single-digit percentages. Due to this, the public auto dealerships were all cash profitable during the Financial Crisis.

The industry’s highly variable cost structure aids this profitability during recessions. Auto dealer’s costs mainly consists of employees and advertising. Both of which can be cut quickly as car sales begin to decline. And, with commission-based sales at dealers, much of the costs cuts are “automatic” (i.e., less sales = less commissions)

The extent of the franchised dealer’s variable cost structure is actually pretty extreme. For example, GPI states in their latest investor presentation that parts/service gross profit covers 110% of total company fixed costs + parts/service variable selling expenses (the “Absorption Ratio”). Said another way - without any car sales, GPI’s parts/service gross profit can cover all their fixed costs and still produce a decent profit.

Overall, this industry structure creates a very defensive business model. The industry could not be more different than the U.S. auto manufacturers, which requires large CapEx and high fixed costs - both causing equally high operating losses during the recession of 2008-2009.

2.) Long-Term Trends

(1) New car sales - in the long-term - are primarily driven by population growth. New car sales have increased steadily over the decades, exceeding 17mm per year in the many years prior to COVID. Post-COVID sales growth has been restrained by both a chip shortage, and now a desire by auto manufactures to produce less cars, but sell them at higher margins to help fund the expensive EV transition (more on that later).

In recent history, ~12%-13% of U.S. households purchased a new car yearly (see chart below). Recessions might drive this figure below 12% temporarily and booming economic environments might drive it to 13%+.

(2) U.S. households increasingly shifted to multi-car households.

Fifty to sixty years ago many households were one car households. Decade-by-decade the average U.S. household increased their car ownership, as shown in the chart below. Even in the past decade, with the rise of Uber, the number of owned vehicles has stayed fairly consistent.

(3) Car repair inflation exceeded overall inflation while new and used has lagged.

New and used car pricing has lagged overall inflation over the past few decades, while vehicle repair price increases has consistently exceeded inflation. The data also shows how new/used inflation has been flat since the mid-1990’s (prior to the COVID shortages).

The interesting point with all the repair inflation, much higher service margins might be expected at auto dealers. However, using AutoNation as an example, parts/service margins were ~43% in 2001 and now are ~46%. The small margin increase despite the substantial price increases implies high cost inflation for service departments as well.

Summary of thoughts on the data:

Averaging the economic booms and busts, ~12-13% of the U.S households buy a new car yearly. This is subject to change now that the auto manufacturers might produce less vehicles going forward, and therefore, new car prices may be higher relative to household income.

The U.S. has become a multi-car household over the past fifty years. The rise of ride-sharing in the past ten years has seemingly not decreased ownership.

In recent history (excluding COVID), new/used pricing is flat, while car repair inflation continues to increase at a rate faster than overall inflation.

All this adds up to a slow-to-no unit growth industry, with overall revenue growth likely running below inflation (0%-2% growth). Of course, dealership groups located in geographies with above average population growth could experience slightly more favorable growth. But at best, this is a slow revenue growth industry.

3.) Competitive Advantages

The auto dealership industry does not have many of the typical competitive advantages. Scale advantages are mostly not available. Certain back-office functions can be consolidated - creating some small scale efficiencies for larger dealership groups. But, a 2-store dealership group, will buy their new/used cars at roughly the same prices as the 20-store dealership group.

Below is a discussion of competitive advantages by business line:

New Cars

U.S. franchise laws restrict new car dealership competition. For example, two Toyota dealerships will not be located next to each other. There might be another one 15 miles away but not right next door. This helps limit competition and creates more sales per dealership, aiding margins.

Further, the number of new car dealerships has declined from ~30k+ many decades ago to ~17k today. This has occurred while the number of new cars sold has increased over time as the U.S. population expanded and many households became owners of multiple vehicles. This further reduction in new car competition helps dealership network margins, with more vehicles sold from less sites.

Used Cars

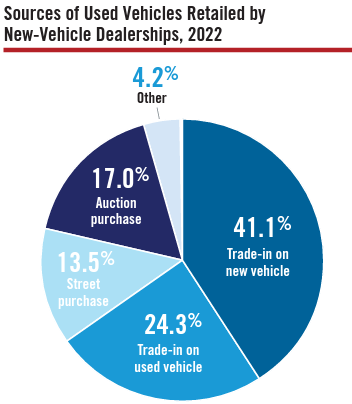

On used cars, new car dealers also compete against used car only competitors. New car dealers do have a lower-cost sourcing advantage, driven by trades for new cars increasing that dealership’s used car supply. Think about this versus the purchase of a used car: when a used car is purchased, the purchasing consumer can only maintain that dealers used car supply (buy one used, trade-in one used). Whereas when a new car buyer does a trade-in of their used car, they are effectively increasing the used car supply of that dealer. Without this, additional used cars would need to be found via other sources, mainly auctions that require various fees and transportation costs (and added time, and thus increased depreciation).

New car dealerships also benefit from lease returns, creating a “built-in”, ongoing source of used car supply.

Parts & Service

In some ways, franchised new car dealerships operate under the razor / razor blade model: sell the original product for cheap but create a higher-margin recurring revenue stream. This concept definitely applies to dealership’s selling new cars and receiving the much higher-margin warranty work (typically 55%+ margin). Although, once the warranty expires, customers are no longer tethered to the dealerships.

New car dealers largest competitors in service are independent repair shops. To my knowledge, no one has ever gone to a dealership for service cause they thought it was the lower-priced option. Rather, people choose dealerships due to better service quality (real or perceived). Dealerships do have highly-trained technicians that specialize in the brand and use manufacturer (OEM) parts. Also, cars are increasing in complexity, requiring additional investments that might be too large for mom-and-pop independent repair shops.

Regardless, since price seems to be a secondary consideration for people choosing service from a dealership, this does create some pricing power. Of course this depends on the car. Although I have never seen the data, I would assume luxury dealerships retain a much higher percentage of their customers for service work than, say, an import brand’s service department. Also, the newer the vehicle, the higher the retention rate at dealerships for service (see chart from GPI below).

Dealership’s parts department also sell their auto manufacturers parts to independent repair shops. So even when a customer leaves a dealership’s service network, that dealership can still benefit by selling parts to wherever that customer chooses to have their vehicle serviced.

Finance & Insurance

On finance, most auto manufacturers own their own finance companies (“captives”). Since most auto manufacturers want to incentivize additional new car sales, they will periodically offer 0% APR deals on new vehicles. For a customer considering both new and used vehicles, and seeking financing, this can be a powerful incentive to choose new over used.

Overall, a customer choosing to get finance/insurance offers at a dealership is choosing convenience. For example, they do not need to shop around for loan rates prior to visiting the dealership - it is handled all on-site. In exchange, the dealership receives its commission from the lender for acting as a middle-man.

4.) Industry Economics

“The car dealership business, if run well can be a very good business. You have no receivables to speak of, you floor plan your inventory, you can lease your real estate – we don’t do that, we own 95% of our real estate – but you can have very little capital actually invested in the business and you can do a large volume…You work on fairly narrow margins and still earn a high ROC if you don’t tie too much capital in the business.”

- Warren Buffett in Fortune interview after Van Tuyl dealership acquisition

As Warren Buffett states, auto dealerships can be an asset light business, creating fairly good economics.

This is mainly due to zero need for net working capital. Sales are not outstanding for long to consumers, creating a small amount of receivables and net-out against the similarly small accounts payable. The largest working capital component, inventory, is funded by floorplan financing - floating rate debt backed by inventory.

Also, a dealership’s branches can easily be leased or bought and debt-funded, further reducing the shareholder equity needed in the business.

Combining zero net working capital need and zero need for real estate capital means sales can organically grow at a dealerships without additional capital required to generate those sales. Although low net margins exist for dealerships, their asset-light balance sheets typically create high returns on tangible equity/capital.

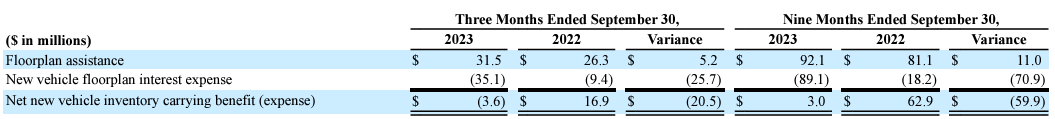

However, floorplan financing creates interest rate risk. By utilizing this floating rate debt, dealerships become interest rate sensitive. Due to this, certain auto dealership groups (like GPI), choose to use interest rate swaps to swap most this floating debt to fixed. However, the auto manufacturers do provide “floorplan assistance” - payments made to dealerships to help offset some of the floorplan interest expense.

5.) Post-COVID Industry Situation

The new car auto dealership industry encapsulates the COVID shortages and ensuing inflation. As COVID hit, the auto manufacturers reduced vehicle production and auto dealerships reduced employee counts. As the U.S. economy reopened, juiced by ample stimulus money, demand fully returned for vehicles but supply could not keep up. Combined with a computer chip shortage (cars today require 1,000+ chips), the amount of new cars manufactured was highly limited up until the beginning of 2023.

With high demand and not much new car supply, order books were created, with many Americans buying and not driving away in those new cars same day. This dynamic created skyrocketing new/used vehicle prices and much higher margins on new/used cars.

The supply/demand mismatch meant advertising was less necessary, lowering overhead. Similarly, less employees were needed. Overall, it created a dream scenario for auto dealers - sell less cars at higher margins but with low overall overhead.

The big question for dealers is where do margins end up once the industry fully “normalizes”. The two components that need to be understood are (1) gross margins and (2) overhead.

Gross margins are mainly inflated due to new car margins remaining elevated as inventory levels are still low. The argument is often made that the auto manufacturers will keep production restrained to help keep new car margins high. They state that this higher profitability will help them fund the large capital expenditures required for the gradual transition to electric vehicles.

But, the auto manufacturers are prone to acting poorly for the sake of market share. Even if today they do stay restrained on producing vehicles, it just takes one or two who realize they can push increased units at these higher margins. The others, seeing these strays make easy profits from their restraint combined with watching market share losses to them, seem likely to react by also producing more units. A weird game theory issue develops, where the industry ends up back over-producing vehicles at low margins.

During and post-COVID, dealerships were able to sell vehicles with less employees and advertising. Almost every public auto dealership group loves to cite how each employee is now much more productive (i.e., more sales per employee).

I do find it suspicious that dealers found these efficiencies once new car shortages started. Of course in a shortage environment they will sell less cars at higher margins, need less employees and less advertising to sell those fewer cars, etc. If the changes were truly structural I’m surprised you did not see this in the years immediately preceding COVID.

So how to get comfortable with downside if margins fully revert? I think a simple analysis helps. As mentioned, public dealerships used their windfall 2020-2023 COVID shortage profits to make acquisitions and/or repurchase shares. If you assume the new level of estimated revenue and shares outstanding but then assume net margins fully revert to 2019 levels, you get some interesting conclusions.

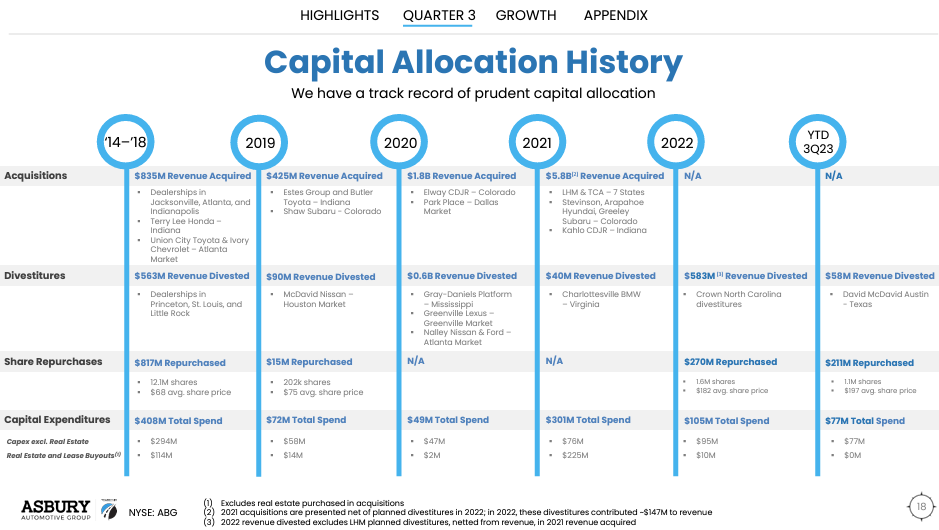

Even under this full reversion scenario (see above), the implied P/E ratios for some are around the ~10x earnings range that public dealers traded for pre-COVID. And, this assumes that the reversion occurs “today”, meaning the excess earnings stop immediately which seems very low probability. Also, many of the dealers have structurally increased their margins for various reasons. For example, GPI sold their low-margin Brazil operations in 2022. ABG sold their low-margin Mississippi dealerships, while purchasing high margin, high quality dealerships such as the recent Jim Koons Automotive acquisition.

This article is not meant to be one on valuation but some of the current valuations from a downside perspective are possibly interesting.

6.) Future Risks/Changes to Industry

Economic risks to auto dealers are low. However, they are interest rate sensitive due to the floorplan financing funding their inventory. That means in a sustained high interest rate environments, dealers must choose to either equity fund some of their inventory to reduce interest costs or incur the profit hit from their higher interest costs. Since auto manufactures provide floorplan assistance, they do help offset some of this risk. And, dealers can always choose to use interest rate swaps to fix the debt - although they need to make this decision before rates are expected to be high.

Outside of interest rate risk, the major non-economics risks are outlined below:

Parts/Service business lower profitability from transition to electric vehicles

The verdict is still out on whether the switch to slow change to electric vehicles (“EV’s”) will help/hurt/do nothing to dealership’s service business. Electric engines versus internal combustion engines have many less parts. Less parts means, less breakage and less for service departments to do.

While most public auto dealership CEOs agree on the above, they differ in the ultimate revenue impact. Some argue that although EV’s come into the service centers less, when they do come in the order ticket is larger - creating a net zero impact to revenue. Some argue the opposite or argue somewhere in-between.

The EV shift could push more service work to dealerships as opposed to independent repair shops who are unable to make the required upgrades to service EVs. Also, in the early generations of EV production it is likely that more issues could occur (as with any newer technology).

Five years from now, with more EV’s on the road and less being first-generation, we’ll know much more on where on the spectrum of revenue impact the truth lies.

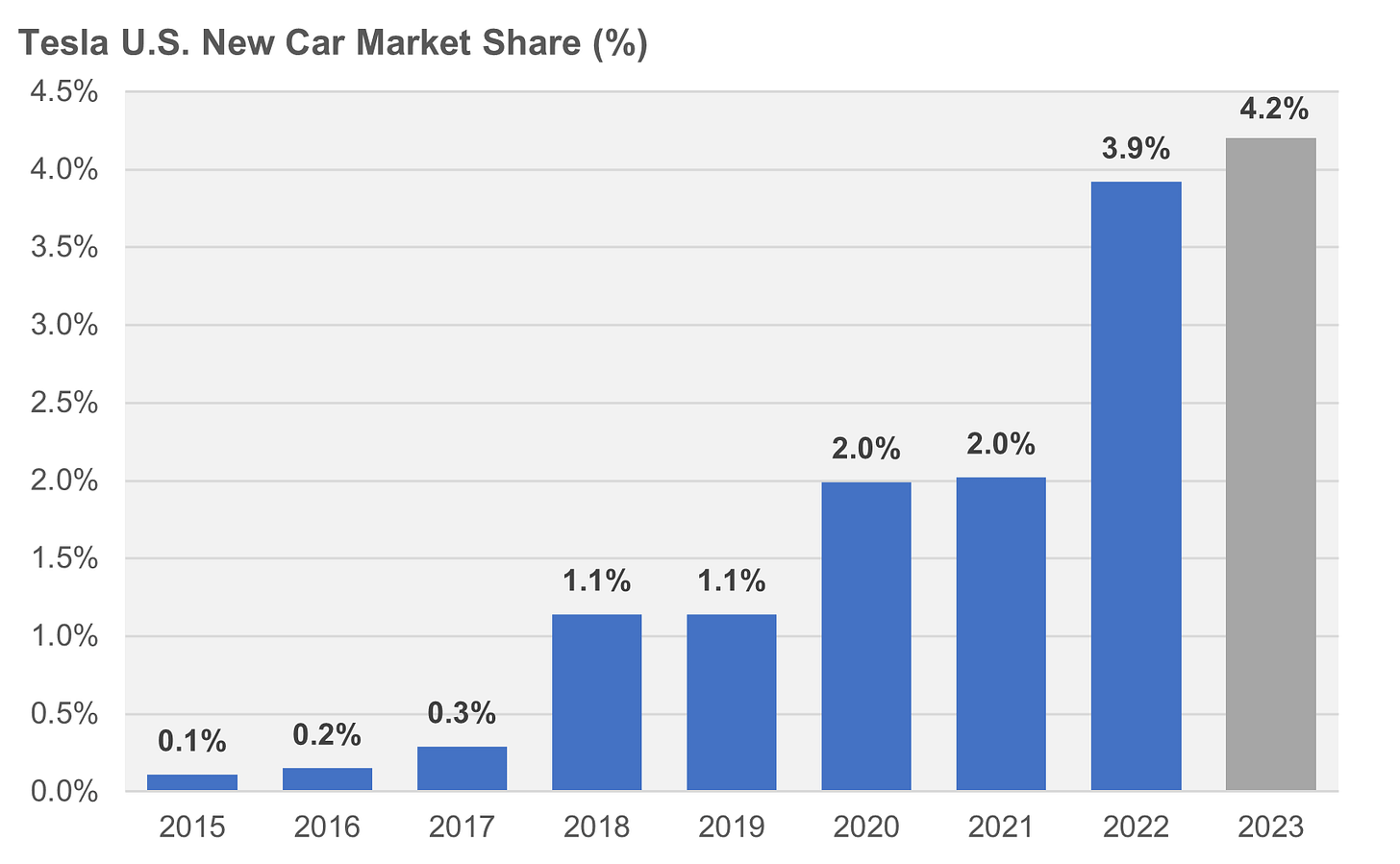

Increasing market share of Tesla and other non-dealership utilizing auto manufacturers

One of the less cited risks is the rise of Tesla. Every sale of a Tesla or other vehicle outside the traditional dealership network is a lost revenue dollar. The more Tesla and others grow and gain U.S. market share, the more of an impact they will have on traditional dealership groups. Less sales out of the same number of dealerships means negative operating leverage. For a low-margin business this could have an out-sized impact.

Of course, the industry might adjust by increasing margins on one of their business lines. The industry did operate with roughly twice as many dealerships in the U.S. at one point. Overall, tough to tell the ultimate impact but is definitely an area to watch.

Switch to Agency Sales

Agency sales means the auto manufacturers sell the vehicle and the auto dealer receives a small commission as a middle-man. This means less revenue for the dealer but the actual profits generated in the transaction is what matters.

Certain brands are beginning to implement an agency model in the UK. The early response on agency is minimal-to-no profit impact. For example Penske, which operates UK dealerships, said the gross profit per unit sold (including F&I) under an agency model is higher than what was generated in 2019, prior to elevated car prices/margins.

The other benefits for the dealer are no marketing costs and no floorplan interest expenses, since no inventory is actually owned by the dealer. This makes an asset-light business model, currently curtesy of inventory floorplan financing, a truly asset-light business model - no inventory owned whatsoever. For people worried about the economics of this model, so far the worries seem much over done.

The other important fact, specific to the U.S., is that auto manufacturers are not allowed to sell direct to the consumer in nearly all states. For the agency model to arrive in the U.S., this would need to change.

7.) Overview of the Public Auto Dealers & their Capital Allocation Strategies

Given the asset-light nature of the industry and defensive business models means dealerships continually produce cash available for management to allocate. Prior to COVID, most public franchised dealership groups chose a mix of buying additional new car dealerships and repurchasing shares. Post-COVID, some have chosen to become more aggressive with acquisitions and others are choosing to venture out of buying only new car dealerships.

Below is an overview of each public new car dealer, with an emphasis on their current capital allocation strategies.

AutoNation - “The Share Repurchase Machine”

AutoNation AN 0.00%↑ has a focus on the Sunbelt region of the United States, where more desirable demographic trends exist. Long-time CEO, Mike Jackson, retired in 2021, with former CEO of Fiat Chrysler (now Stellantis STLA 0.00%↑), Mike Manley taking over. Mike Jackson was CEO since the early 2000’s and was instrumental in transforming AutoNation when it was a hodgepodge of auto assets formed by Wayne Huizenga (billionaire of Waste Management and Blockbuster fame). Jackson shrank the business by closing its money-losing used car only mega stores and spun-off its car rental business.

Jackson gained respect as a capital allocator as he aggressively bought back shares when undervalued. AutoNation’s share count shrank by ~80% throughout his tenure as CEO (until his retirement in 2021). He was not against buying other dealerships bought often found buying back shares to be the better choice for capital and often did so aggressively.

He also mentioned that AutoNation’s large size was an issue in acquisitions. When seeking to do an acquisition of a certain brand, that brand’s manufacturer would apparently make the approval of the acquisition conditioned on AutoNation putting additional capital into current owned stores. This often created undesirable acquisition economics (which the auto manufacturers seem to have eased up on) for AutoNation specifically - another reason share repurchases became so emphasized.

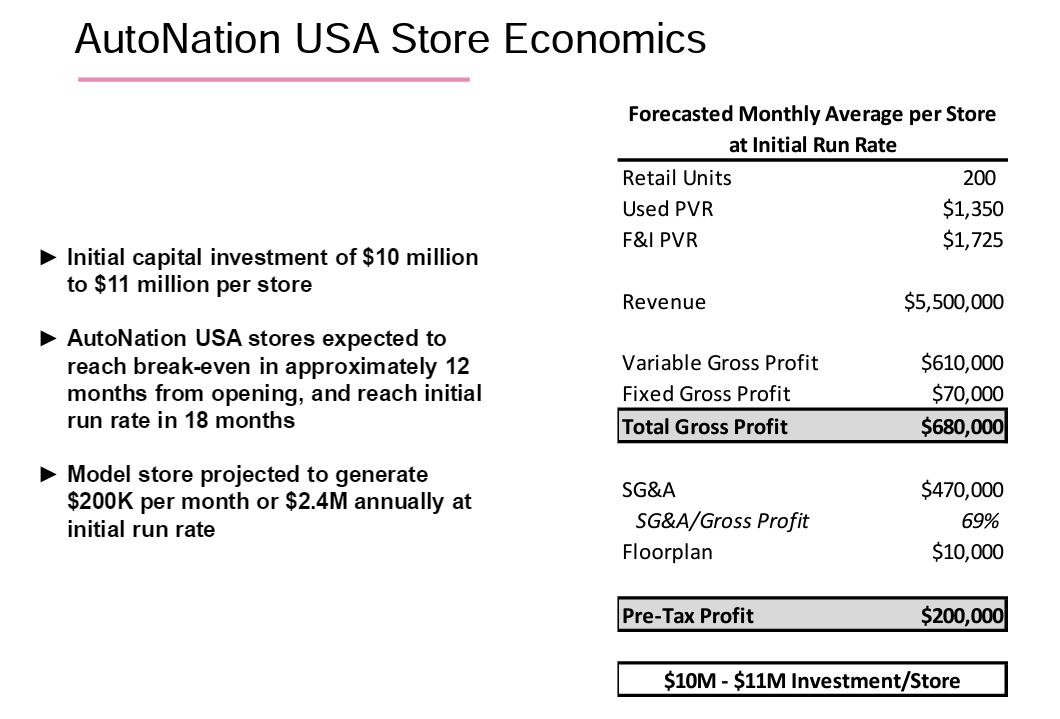

One of the last moves Mike Jackson did prior to retirement was to start a standalone used car business called AutoNation USA. AutoNation is still in the beginning stages of introducing these stores but they claim desirable economics (see below).

When Mike Manley initially came in as CEO he seemed to indicate a desire to shift to growth. But, so far, he has not shown a “growth-at-all-costs” mindset. AutoNation continues as a large repurchaser, especially when undervalued in 2022. The following quotes sum up their approach so far:

CEO Mike Manley (on 22Q4 Earnings Call) → “the very first thing that we think about is what is the best use of capital for our shareholders' perspective. And clearly, you have seen over the last 2 years, given the market conditions and the overvaluation of assets out there, the best return was to return it to our shareholders, and we're very clear on that, and we'll continue -- our discipline will continue to be with that in mind. … Our approach is to firstly maximize the assets that we have in place and in appropriate circumstances to add to that, that will broaden our geographical coverage but be very deliberate.”

COO Joe Lower - was CFO at time of comment (on 22Q4 Earnings Call) → “let me just add, I'll call a boring finance answer to some of this. Because strategically, Mike was, I think, very clear in [articulating] what we're trying to do. When you match that with the financial or capital strategy, we have a first-class problem. We have robust cash flow and a very strong balance sheet. So then the question is how do we utilize that and maximize the benefit of it? And it's not surprising to most. It's an IRR-driven approach, and we look at what the return is on each opportunity. We have, obviously, as Mike mentioned, in the recent past viewed share repurchase as an extremely attractive opportunity.”

“As we look forward, we have found some opportunities that offer very, very compelling returns. And as we think about capital going forward, we will deploy it in a similar fashion and identifying where there really is truly incremental value. And I think you were going to ask about the Finance business, and I think we've been very clear that, one, we're going to be delivering this growth, and we will utilize facilities that we are not funding all of that directly from our balance sheet as it's typical and in some ways, similar to the way you think about floorplan. So we're not going to be putting dollar for dollar behind the capital business at the expense of other opportunities.”

AutoNation under Manley has done two non-traditional acquisitions. In late 2022, they acquired CIG Financial, to serve as their captive lender for $85mm.

AutoNation also announced in late 2022 the acquisition of RepairSmith, a mobile auto service provider for $190mm. This allows AutoNation to reach customers that leave service department of an AutoNation store. And although RepairSmith offers mobile service, if the issue is complicated enough, the car will be transported to the nearest AutoNation for service.

Both of these acquisitions are relatively small compared to AutoNation’s ~$6bn market cap but provide interesting potential.

Group 1 Automotive - “The (possibly) Reformed Capital Allocator”

Group 1 Automotive GPI 0.00%↑ has a heavy geographic concentration in Texas (represents ~37% of GPI new car sales in 2022), one of the fastest-growing states in the U.S. GPI also owns dealerships in the U.K. (~19% of new car sales) and previously owned franchises in Brazil prior to sale in 2022.

Prior to his retirement at the end of 2022, GPI was run by long-time CEO, Earl Hesterberg. He became CEO of GPI in 2005 and ran what was frankly a sub-par operation with lower-than-peer margins and questionable capital allocation decisions with a large focus on acquisitions.

The worst period was post the Financial Crisis from 2011-2014, where stock was issued to grow rapidly via acquisition. Revenues increased from ~$6.5bn to ~$10bn over the time period but earnings only grew modestly and EPS remained roughly the same due to the share dilution.

Beginning around 2015, GPI began to do less, while focusing more on repurchases. As shown in the above table, average diluted shares outstanding declined at a ~6% rate from 2013-2019. Their “tune” on earnings call also shifted, increasingly mentioning that acquisitions were over-priced and therefore chose not to participate.

From my GPI write-up last year - summary commentary on their capital allocation considerations:

“However, like any good operator, GPI has evaluated many of these ventures that the other public dealers are choosing to take on. On starting their own captive finance company, GPI noted on their 22Q2 earnings call, they are not interested – believe they have supportive finance partners currently and don’t want to add fixed costs to their business model. On standalone used car sites, mentioned as far back as 2015 how hard it is to make that model work, while discussing how three of the other public dealers failed in their attempts at starting standalone used-car sites.

GPI has intelligently realized that there is an opportunity in the used car space but they think they can utilize their existing infrastructure. In 2018, GPI introduced “Val-U-Line” used car offering which is just GPI retaining more of 6-10 year old cars instead of sending those to auction. First, this allows them to capture the margin they previously gave-up on those sales when offloading these types of cars in bulk to auctions. Also, GPI could not get the math to work on standalone used car stores so this was their version of it, allowing them to sell additional cars without additional fixed costs / infrastructure (along with their online selling portal discussed in next section). GPI believes this can also help increase the number of people coming to the dealership for service. They have stated they are not necessarily looking to sell cars to people far outside of their current markets. They want to retain their customers and gain future, higher margin, service work from them as well.

Final point on GPI’s capital allocation – they have shown the rare willingness to shrink their business when it makes sense. GPI purchased a Brazilian auto dealership group in 2013. Although they attempted to grow in Brazil, GPI ran into two main issues. One, they could not make additional acquisitions in Brazil it if they did not accept existing liabilities in deals related to tax/employees, and (2) the exchange rate kept deteriorating. Due to these factors, GPI divested their Brazilian operations in July 2022 for slightly less than $100mm (4-5% of current market cap [at time of writing in October 2022]) and can now re-deploy that capital towards better uses.”

…And re-deploy the Brazil capital they did - helping to increase their already large 2022 share repurchase (~18% of total shares repurchased in ‘22). Most of these shares were repurchased at ~4x next-twelve-months (peak) earnings.

One of the unique items about GPI is that they utilize interest rate swaps to hedge the floorplan debt interest rate risk. The swaps mean that ~65% of their total debt is effectively fixed. GPI has done this for many years, which seems very prudent for a business with lots of floating rate interest.

Regarding management, Daryl Kenningham, former President of U.S. Operations since 2017, became CEO after Hesterberg’s retirement at the end of last year. Not much seems to have changed, with both Kenningham and Hesterberg having similar operational backgrounds. Kenningham does seem to have a slightly higher desire for acquisitions. We’ll see if GPI’s capital allocation discipline can be maintained going forward.

Penske Automotive Group (PAG) - “The Well-Run Diversified Dealership”

Penske Automotive Group PAG 0.00%↑ is one of the larger Penske Corporation’s non-fully owned subsidiaries (they own ~51% of PAG). Penske Corporation is the holding company for billionaire and former race car driver, Roger Penske.

PAG is different from the other public auto dealerships, both in their auto dealership mix and by also owning non-auto dealership businesses.

First, their auto dealership mix has a much higher non-US mix and is heavily weighted towards the Premium/Luxury segment. To put numbers behind this, PAG generates 58% of their revenue from the U.S., with the other 42% coming from outside of the U.S. (primarily from the UK). Additionally, ~70% of revenue is from Premium/Luxury brands such as Audi, BMW, Land Rover, Mercedes-Benz, and Porsche. And in the UK, 93% of unit sales are attributable to Premium/Luxury. As an interesting note, PAG has 35% of Ferrari sales market share in the UK.

Second, PAG owns a few other businesses outside of auto dealerships. The two other major business lines are (1) Penske Premier Truck Group - truck dealerships for medium-to-heavy duty semi-trucks and (2) Penske Truck Leasing - lessor of semi-trucks, managing a fleet of 400k+ trucks/tractors/trailers.

Trucking represents 35% of PAG profitability, while auto represents the other 65%. The truck business is an interesting with a very large service component, along with strong monopoly-like competitive advantages.

Commercial truck business commentary from a November 2021 conference:

Seeing multiples in the 6-6.5x range versus auto dealers in the 8-10x range

Currently “better return on capital” than auto dealer acquisitions

Generate 60-70% of gross profit on truck side via repairs and services

Also less capital intensive since do not need to build fancy dealerships

“just a big … truck box out along an interstate somewhere”

More of a monopoly than auto dealers

“the difference between a truck dealership and a car dealership is if you're in a given area and you have a car dealership, you may see 3 or 4 different Toyota stores, and they're all going to be owned by somebody else, right? You're not going to dominate or have one market where you own all the stores in the marketplace. On the truck side, we own Dallas. We own Kansas City for that brand. …so they give you these big markets instead of just one store in a given market.”

PAG also owns a few other small businesses including a growing used car business called CarShop. They have done well with this diversified approach, providing themselves more areas to allocate capital - especially via acquisition. Despite this, they have also intelligently repurchased shares at appropriate times.

Commentary on share repurchases vs. acquisitions at November 2021 conference:

“But in most cases, we don't want to pay for a dealership there more than what our stock is trading at. We've got the different alternatives. And if we can buy back stock at a lower rate than it takes to invest in store, it just makes more sense to us.”

Overall, PAG is a very well run diversified operation.

Lithia (LAD) - “The Highly-Aggressive Acquisition Machine”

After the Financial Crisis, Lithia LAD 0.00%↑ completely transformed their business operations and capital allocation. This transformation occurred when founder, Sydney DeBoer transitioned the CEO role to his son Bryan DeBoer in 2012.

First, the business was morphed into a much leaner organization - often running at the lowest SG&A/gross profit in the industry (a common cost measurement KPI for auto dealers). Although tough to tell as an outsider, Chris Holzshu, current Chief Operating Officer, seemed to be the force behind the operational/cost change. On quarterly earnings calls, he has usually been deferred to on anything concerning operational efficiently, cutting costs, etc.

Second, the LAD team applied the same approach and turned into an aggressive acquirer of dealerships, many of them underperforming. LAD would cut costs, and apply best practices in a private equity like approach to these acquisitions. LAD was extremely effective at this strategy and mentioned in 2020 that they achieved 25% rates of return historically on these underperforming acquisitions.

The combination of better-run legacy operations and lots of revenue acquired at cheap pro forma earnings created an earnings growth machine. From 2006-2019, Normalized EPS grew at 14.6% per year - the best among the public auto dealers.

In 2020, LAD transformed from an aggressive acquirer to an ultra-aggressive acquirer, announcing a 5-year plan to reach $50bn in revenue by 2025. To achieve this goal, LAD could no longer buy only small underperforming assets - they needed to acquire much larger dealership groups, many of them high performing.

They admitted as much in their 3Q20 earnings call that their return thresholds will have to be reduced in order to achieve that growth:

Bryan DeBoer (CEO) - “Now when we think about the 5-year plan to grow at $4 billion annually for an aggregate of $20 billion … we really look at that our typical strategy of buying value-based strong assets that aren't really performing at the strong level, we're only going to be able to buy about $1 billion to $1.5 billion of that, which is our traditional model levels of growth, okay? So about 3/4 of the future growth will come from these … type of acquisitions that are better performers.

So the return dynamics still will be over the 15% after-tax return thresholds. Because doing the value type investing, we've achieved over 25% after-tax returns over the last 10 years. And there's some -- we have the ability to still be able to do that while buying a lot better acquisitions that are much easier to integrate and have a much higher probability of success.”

To fund some of this growth, Lithia also issued ~$2bn of additional stock over 2020-2021, increasing shares outstanding by 25%+. Diluting shareholders is not typical behavior of shrewd capital allocators but, admittedly, the 2021 stock issuance was at a $322/share, a price above where they stock trades today.

LAD also ventured into a few additional areas:

Driveway

Driveway is LAD’s online, used car platform. However, it differs from Carvana and other online-only sellers in that the existing LAD dealership network can fulfill most of the required functions. Mentioned in a special investor call in 2021 on Driveway that LAD only uses 25% of storage capacity and 50% of reconditioning capacity. This means no incremental infrastructure capex is required besides some additional technology costs.

Due to the above, Driveway (and other traditional dealerships), can use these online selling platforms to sell used cars with advantages versus the online-only players. Little additional infrastructure capex, combined with lower vehicle sourcing costs from their existing new dealership network allow for powerful advantages.

Driveway Finance

As discussed, most auto dealers simply take a commission for connecting consumers with finance providers. Driveway Finance is Lithia acting as a direct lender option to consumers, funding the loans themselves. Driveway Finance then bundles those loans and securitizes them for sale.

Lithia believes by directly lending this is the higher profitability path, as opposed to a pure commission finance model. This operation has only been active for a few years and remains to be seen how it does in the long-run.

International Acquisitions

In addition to aggressively pursuing in the U.S., they are also looking internationally. LAD announced the acquisition of Canadian-based Pfaff Automotive in 2021. In 2023, LAD expanded into the U.K., by acquiring two large dealership groups (Jardine Matheson and Pendragon).

Non-Auto Dealership Acquisitions

Lithia is attempting to do some of what Penske has done by expanding outside of only owning auto dealerships. Lithia seems to want to grow into even more niches than Penske and have mentioned selling anything from RV’s to agricultural vehicles.

Lithia is attempting to achieve much all at once - not an easy feat. There is no doubt that their historical track record of acquiring underperforming auto dealerships is second-to-none but they are now venturing in new directions. If they can pull off all their grand visions, future performance will likely be a Grand Slam. Regardless, Lithia’s story will be an interesting one to watch unfold over the next 5-10 years.

Asbury (ABG) - “The Aggressive, High Quality Dealership Group”

Asbury ABG 0.00%↑ dealerships are mainly located in the southern and western U.S., in better demographic areas. Similar to Lithia, transformed over the last 15-20 years. The transformation began during the 2008-2009 recession and continued when the then CFO, Craig Monaghan became CEO in 2011 (joined ABG as CFO in 2008). At a 2012 investor conference, Monaghan details the 2008-2012 years well:

“If you would take us into a 2008 timeframe, you would have seen a company at that point that was really run as a holding company. We had six regional platforms and each of those six platforms was very much an independent entity making its own technology decisions, its own marketing decisions, had its own personnel philosophies and it was a holding company that was located, the headquarters was in New York City managing this group of companies. So here we are at that time we were sitting in New York City, we were managing the six different platforms, relatively heavily indebted and the recession hit.

Recession hit and it hit us hard…and we actually got [a going] concern opinion from auditors caused a number of covenant issues for us and really forced us to step up and make some hard decisions….there were some severe cutbacks in the way we were spending our capital. We became a much smaller company. We left New York City and moved to a suburb of Atlanta and really went through some pretty draconian changes.

And today I would tell you that we are a very, very different company from what we were just 12 to 18 months ago…We had a heavy-duty truck business, we sold it. Over the past 12 to 18 months we have paid down over a $100 million worth of debt. We have been very aggressive in buying back leased properties [at double-digit effective rates]. We have begun to buy back our shares…and we have worked very hard to get our stores on common technology platforms. A lot of our stores are now on a common CRM, all of our stores are on common set of websites. If you pull it all together, we have gotten to the point that now as we start 2012 again, as a very different entity, for us it is really the first time that we are going to be able to go on the offensive…

So our balance sheet is in great shape. Our leverage is less than three times….We are sitting on excess cash, we just wrapped up a $900 million refinancing, had tremendous financial flexibility to pursue opportunities... We have got a new senior management team in place. …And we have also got a new operating structure in place at our stores. We do not a run at six platforms anymore. Those have all been eliminated. We run as a single enterprise today, common systems across all the stores.

…We have got standard processes, which is creating the groundwork for us to now start to move to shared services. Our strategy is, it’s really pretty straightforward. We want to continue to drive operational excellence. We feel like we are on a path to become a best-in-class operator. We are going to continue to work to maximize the returns on our portfolio [of dealers].

We feel very good about our portfolio, but it is a portfolio that we are constantly fine-tuning. I will tell you that just this past year, we sold a store that we felt we got an extremely good price for. About a year ago, we bought five stores in a package transaction that we are very thrilled with the improvement in performance that we have been able to bring to those stores. But we will deploy capital where we get the greatest returns and… that could be buying stores, but more recently most of our capital has been targeted to paying down debt, buying back leases and buying back stock. I would tell you that 2012 there will also be a heavy reinvestment in …a number of the stores that will we refurbished and we will continue with some of this technology [investment].”

After that 2012 quote, Monaghan continued to improve the operations of the company, allowing ABG to achieve some of the best cost efficiency metrics in many years.

Monaghan not only greatly improved the operations of the company, he also allocated capital intelligently. He was able to both reduce the share count by 1/3+ over his tenure, while also adding revenue via acquisition, and making intelligent lease buy-outs.

In 2018, David Hult (current CEO; was COO since 2014) took over for Monaghan. Hult seems to emphasize acquisitions more, and they are mainly larger, high-quality dealership groups. Hult’s pattern has been to do a large acquisition and then use most/all cash flow to deleverage the acquisition debt. Following this pattern, ABG recently completed the acquisition of Jim Koons Automotive Companies in December 2023. Jim Koons is the 9th largest private dealership groups in the U.S. and generates the 10th highest revenue per dealership in the U.S. Post-acquisition, ABG will do more of the same, using cash flow to deleverage.

In the murky post-COVID world of dealership margins, ABG has likely transformed their margin profile due to these high-quality acquisitions. ABG’s CFO commented on this during their 1Q22 call:

“And everyone keeps referring to 2019, and I brought this up a few times. I'll bring it up again. We will never see 2018 margins again in our company. We're a different company, not because of our size, but because of the accretive acquisitions that we've done. We sold off all of Mississippi, which was our lowest margin platform. And we've increased through Park Place, LHM and Stevenson, [acquisitions] all of them are accretive in margins to where we were in '19. We're also, from a productivity standpoint, under the legacy Asbury stores alone, it hasn't been integrated in any acquisitions yet. But from a productivity standpoint, from 2019, we've had a 50% increase on the variable side for production per employee for sales advisers.”

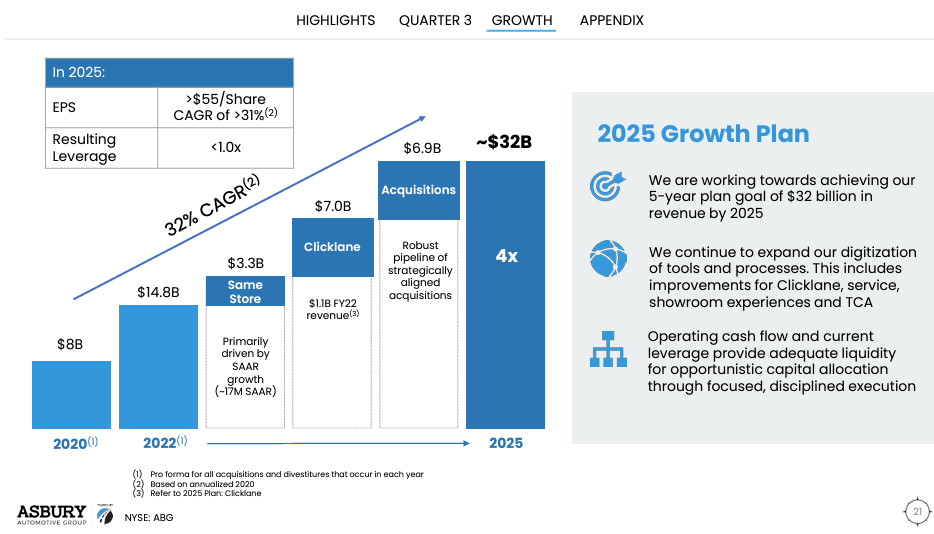

Similar to LAD, ABG has a 2025 growth plan. The plan (as shown below) has ABG growing from $8bn of revenue in 2020 to $32bn in 2025. While they have commented that the acquisition target is achievable, achieving the same store sales growth and Clicklane targets might be difficult in two years time. Clicklane is ABG’s online selling platform.

Again, similar to LAD, ABG issued $650mm+ in stock in late 2021 to help fuel this growth plan. The stock was issued at $182 per share, roughly 10% below where ABG trades today.

Overall, ABG is a very well run business that owns/acquires very high quality dealerships. In some ways, ABG can be viewed as a “cleaner” version of LAD - an aggressive acquirer but without all of LAD’s extra acquisition activity.

Sonic (SAH) - “The Chronic Underperformer”

Sonic SAH 0.00%↑ has been the laggard of the public auto dealerships. SAH is controlled by the Smith family, with David Bruton Smith, acting as Chairman & CEO. The company has a two-class share structure with the Class B shares retaining 10-to-1 voting rights. Class B is held by a variety of Smith family members, thus the ability to control the vote.

Pre-COVID their earnings per share increased marginally from 2006-2019, hurt by stock issuances and weakening EBIT margins.

Outside of their new car dealerships, they also operate a used-only concept called EchoPark. EchoPark is now 52 stores and SAH’s end goal is to reach 90% coverage of U.S. population. In 3Q23, SAH suspended EchoPark operations at 50% of locations, helping them lower adjusted EBITDA losses from $32mm to $5mm. SAH said this partial shutdown allowed to them to better allocate inventory / better fill stores.

In recent years, they have shown more willingness to repurchase stock. However, as both capital allocators and operators, they still have a lot to prove.

8.) Summary

New car dealerships are a low-to-no growth businesses, most likely growing at population growth rates for the regions they serve.

Despite most profits being generated by car sales, dealership’s actual profits generated mainly by parts/service and finance/insurance business.

Defensive business model created by highly variable cost structure and gross margin mix that is ~50% derived from the resilient parts/service business.

Asset-light business model due to ability to floorplan inventory and limited receivables. Creates no net working capital need, allowing most profits to flow to shareholders. Does create some interest rate risk operating with variable rate floorplan - although some dealers choose to hedge out that risk.

Capital allocation in the industry has historically been strong. Since the early-2000’s auto dealership management teams have begun to understand the power of share repurchases when undervalued. Given that the industry is highly revenue cyclical and low-growth, can trade at oddly low valuations at times. With dealerships able to sustain profitability during recessions, this creates compelling moments to repurchase large amounts of stock.

Disclosure: I may hold shares in the companies mentioned. I may buy more or sell my position at any time. Please do your own due diligence before making any investment. None of my posts are investment advice.

This is incredibly insightful, thank you for sharing

Wow, this is a fantastic writeup. I too am a like minded Buffet/Graham/Munger style investor. The car dealership space came across my radar late last year. I did some fairly thorough reserach and concluded that LAD and ABG looked the most attractive to me in terms of valuation, so I bought fairly large stakes in each company in January. I was reviewing an AutoNation writeup on ValueInvestorsClub when I found this page linked in the comments of that AN writeup.

You really helped solidify my thoughts - you clearly have more experience and a deeper understanding of the car dealership industry, while I certainly somewhat violated the circle of competence rule to an extent, but it was comforting reading through this to realize that my thesis seem to hold up even with the extra detail/nuance you provided in this writeup (gotta love a little confirmation bias every once in a while). Anyways, wanted to thank you for posting this publicly as now I better understand my own thesis on the companies in which I hold a stake.