FFD Financial (FFDF) - Short Valuation Update

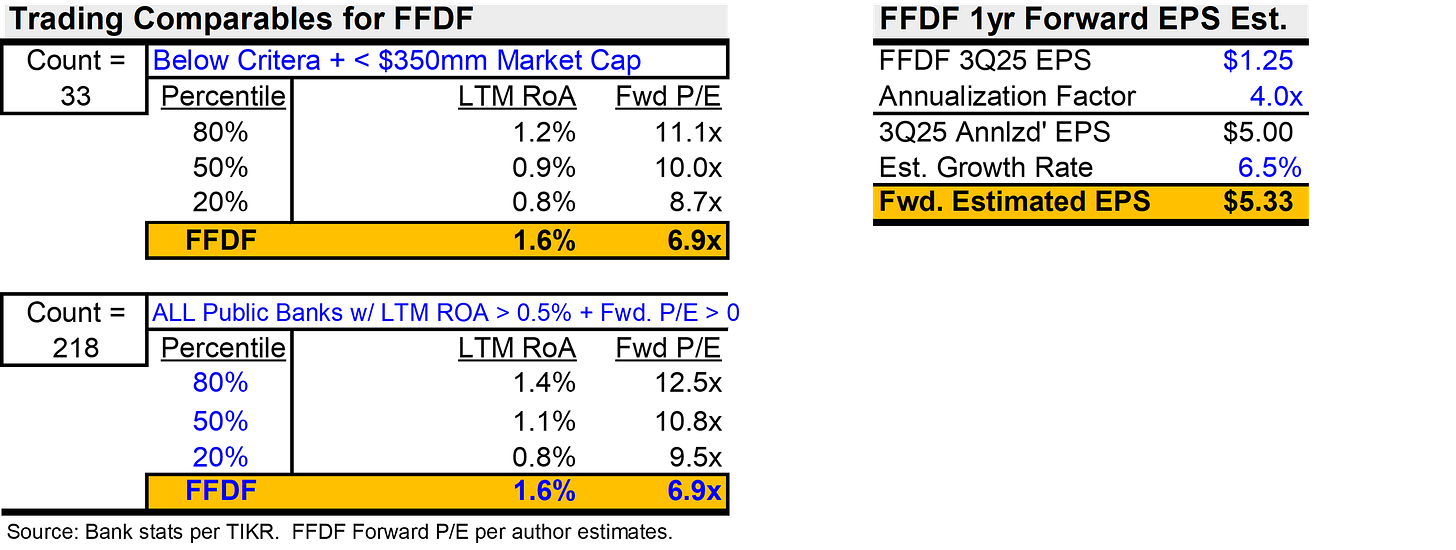

FFDF trades at estimated ~6.9x forward earnings - much below most public banks

I’ve previously written two detailed articles on FFD Financial (FFDF) and I encourage everyone to read those before reading this article. Those were mostly business-focused, whereas the below article will be mostly high-level valuation focused.

(1) November 2022 FFDF Initial Article

(2) February 2024 FFDF Update Article

Summary

FFD Financial (FFDF) currently trades at ~6.9x my estimate of forward earnings. Due to this seemingly low valuation, I recently did a basic valuation analysis on FFDF that I figured I’d share.

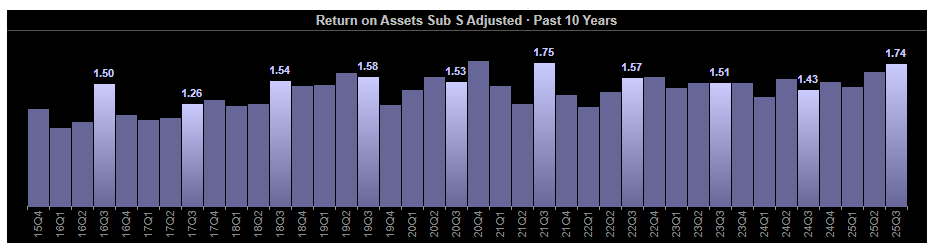

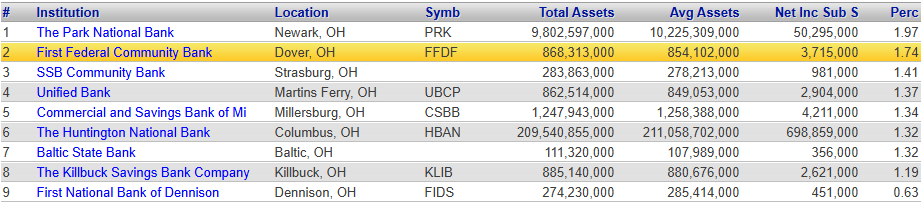

On a P/E multiple basis, FFDF is trading at one of the lowest public bank valuations I can find, but is likely one of the best/better banks in the U.S. due to a high return on assets and very low historical/current loan losses.

As background, FFDF is a ~$100mm market capitalization bank located in Ohio. As I’ve written about before, FFDF achieves an above average Return on Assets mainly via a lower cost structure.

This lower cost structure is achieved thru relatively large deposits per branch and are very effective at generating additional, low-cost, “core” deposits. Said another way, they have more deposits in a smaller branch structure than most peers - creating lower costs per deposit dollar.

Although very good at generating additional deposits at their current branches, FFDF still expands their branch count when they see opportunity. FFDF recently opened a new branch in Canton, Ohio, which likely amplifies future deposit/asset growth for FFDF.

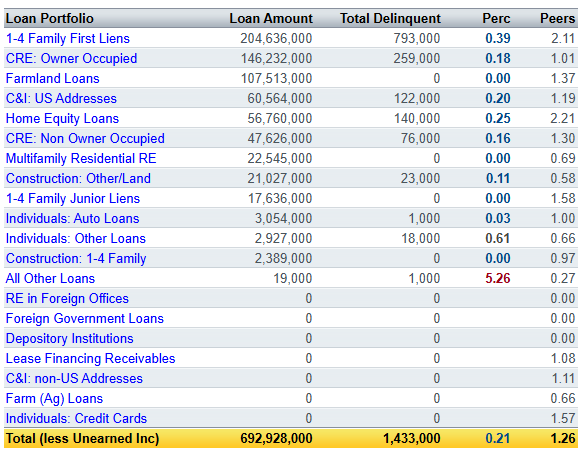

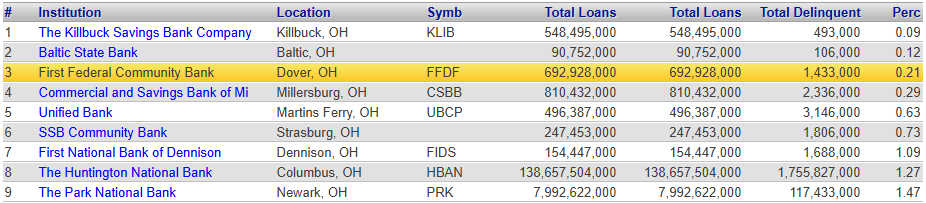

Finally, and probably most importantly, FFDF has a history of low loan losses and maintained profitability throughout the 2008-2009 Financial Crisis. FFDF’s loan portfolio is well-weighted towards historically lower loss loan types. Even within those lower loss loan categories, they currently have much lower delinquency rates than peers.

To summarize: FFDF is a high performing bank via a lower cost structure, with very low current and historical loan losses.

Bank Trading Comparables

Despite its smaller size, one might expect FFDF to trade at a P/E multiple premium to other banks. After all, it produces a high return on assets, while having low loan losses - likely providing more durable / less volatile earnings than the average public bank. In reality, the opposite is currently true, with FFDF trading at one of the lowest P/E multiples among public banks. Depending on the exact comparable group used, it is either the lowest or close to the lowest using a forward P/E multiple (revise my forward earnings estimate if you see it differently).

Note: Although in past articles, I did a more detailed build-up of earnings, I think the above estimate should get close to the same EPS estimate without all the additional complication (the table in the upper right just annualizes FFDF’s latest 3Q25 EPS and then grows by their historical deposit/asset growth rate of roughly 6-7%).

High-Level Valuation Math

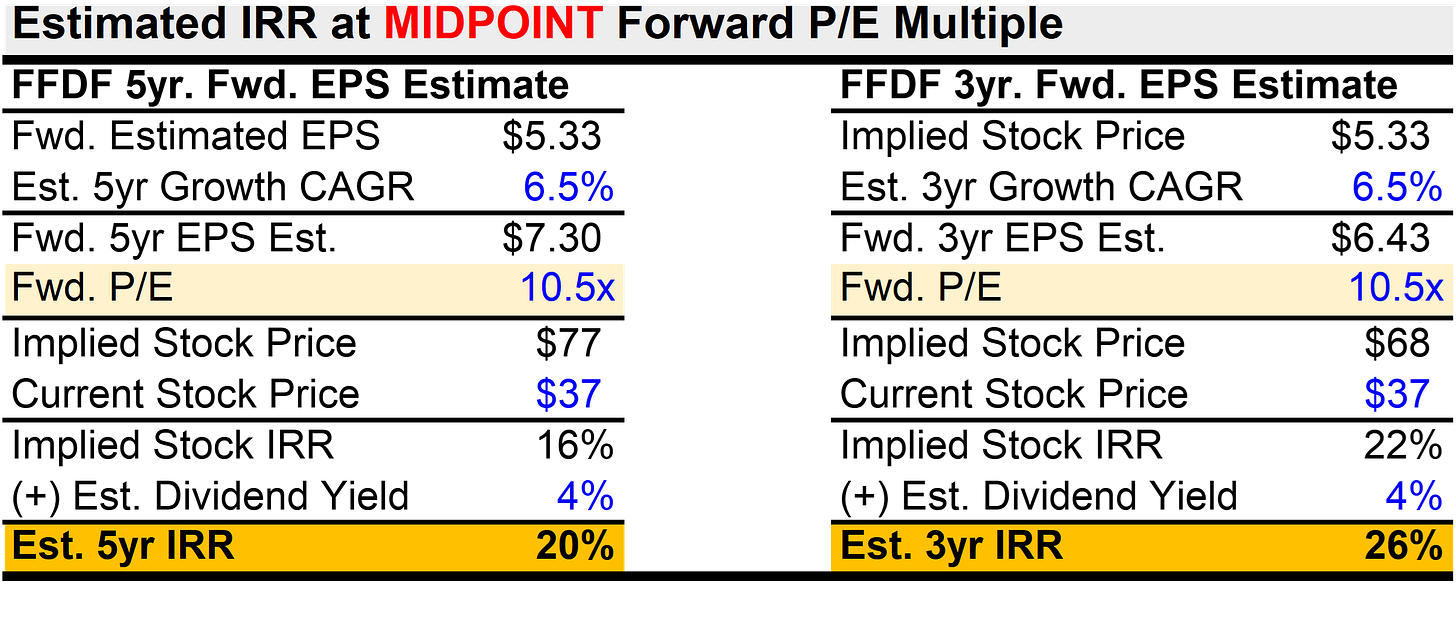

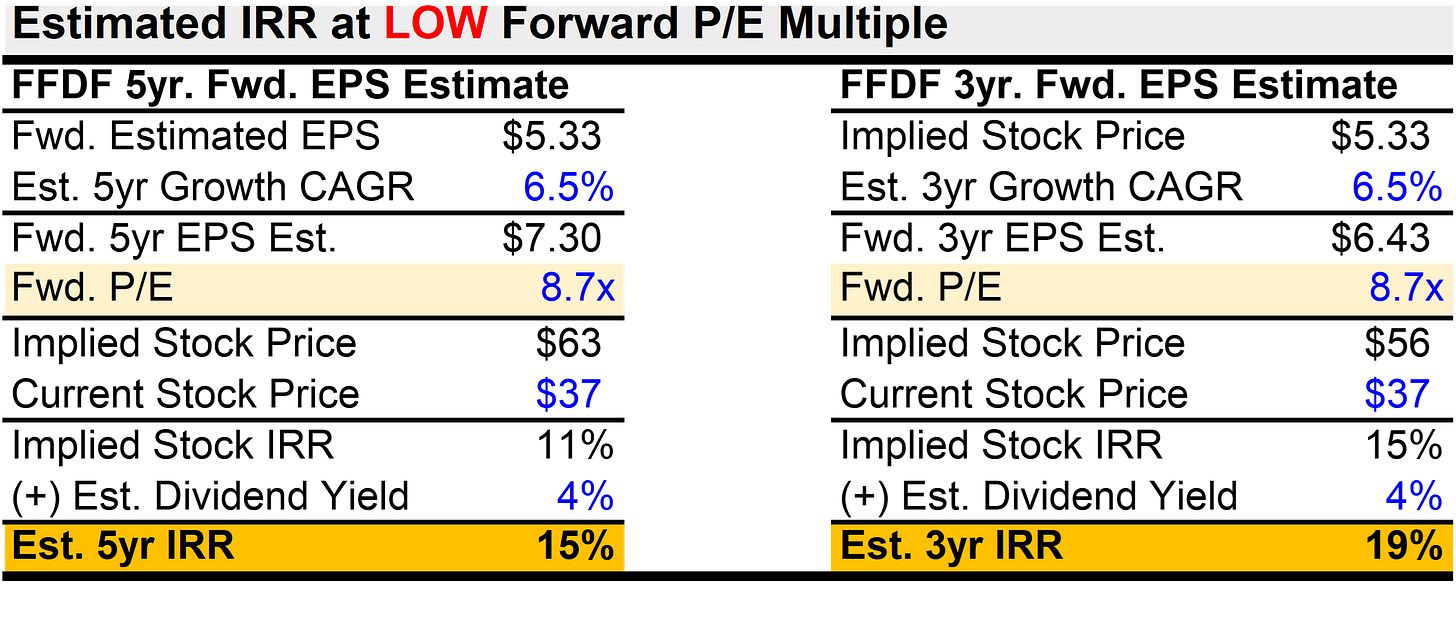

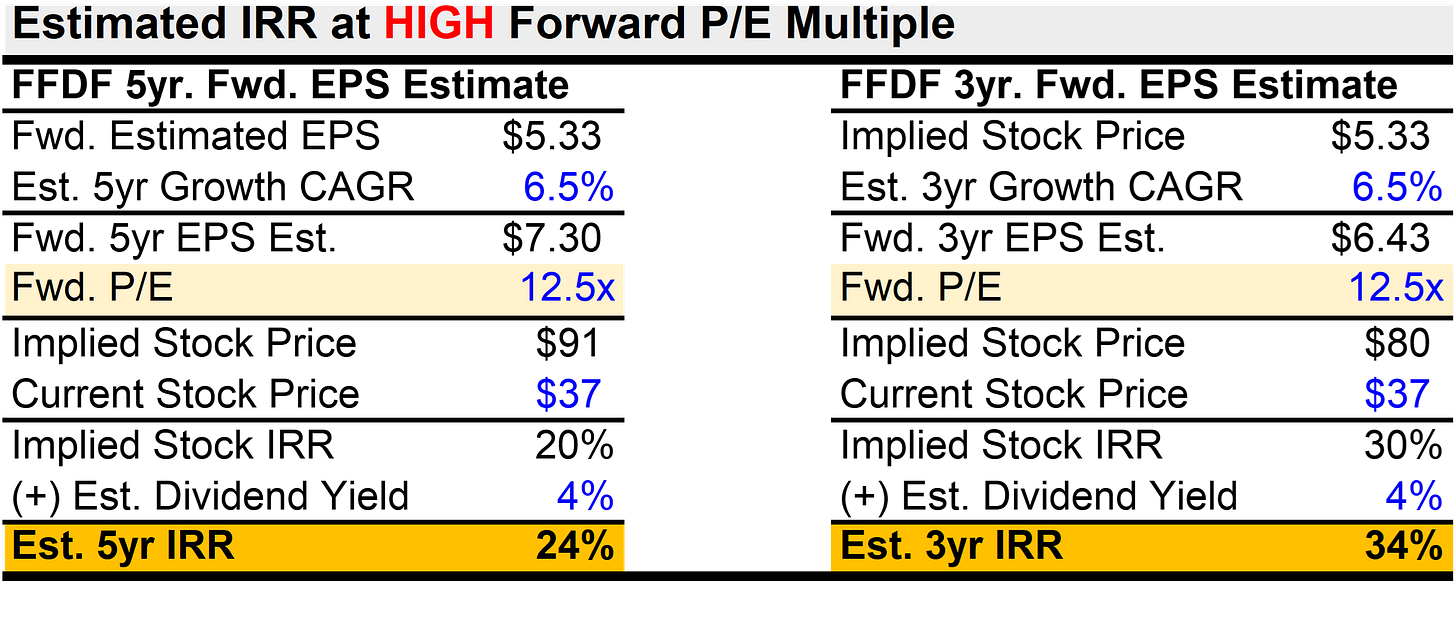

So what is FFDF worth and what could future returns for FFDF look like? Below is a high-level analysis that takes figures from the above bank peer P/E multiple tables and applies them to estimated FFDF future earnings figures. The three below tables are (1) using bank peer midpoint forward P/E multiple of 10.5x on 3-year and 5-year forward estimated EPS for FFDF, (2) using bank peer low 20th percentile of 8.7x forward P/E multiple, and (3) using bank peer high 80th percentile of 12.5x forward P/E multiple.

The ultimate purpose of the below tables is to get some sense of what the 5-year and 3-year IRR’s could be for FFDF if their multiple increases closer to peers. Even using the low 8.7x forward multiple gives a mid-to-high teens IRR return, while using a rough midpoint multiple of 10.5x produces a ~20-26% IRR. Using a higher but still reasonable multiple could push IRR into the 30% range.

Note that FFDF is beginning to approach the point where one could argue they have a bit of excess capital. Due to this, I just rounded-up on the dividend yield to 4.0% - again, this is just a rough valuation exercise I figured I’d share.

Of course none of these scenarios will be exactly correct but I think it is hard to argue that even a slight re-valuation in multiple for FFDF could produce fairly large IRR’s.

Finally, when you compare these potential returns to what seems like a currently very fully valued stock market might do over the same time periods, and it is difficult to see how FFDF underperforms over the next 3-5 years.

Important Reminder: FFDF is a very small bank with a fairly illiquid stock traded on the OTC.

Disclosure: I/we currently hold shares of FFDF. I may buy more or sell my position at any time. Please do your own due diligence before making any investment. None of my posts are investment advice. For full disclaimer, please click here.